Featured

- Get link

- X

- Other Apps

The Depreciable Cost Used In Calculating Depreciation Expense Is

The Depreciable Cost Used In Calculating Depreciation Expense Is. Divide 18,000 by the 100,000 hours of estimated life that the car has, leaving you with 0.18. The depreciable cost used in calculating depreciation expense is a its service from acct 201 at university of nebraska, lincoln

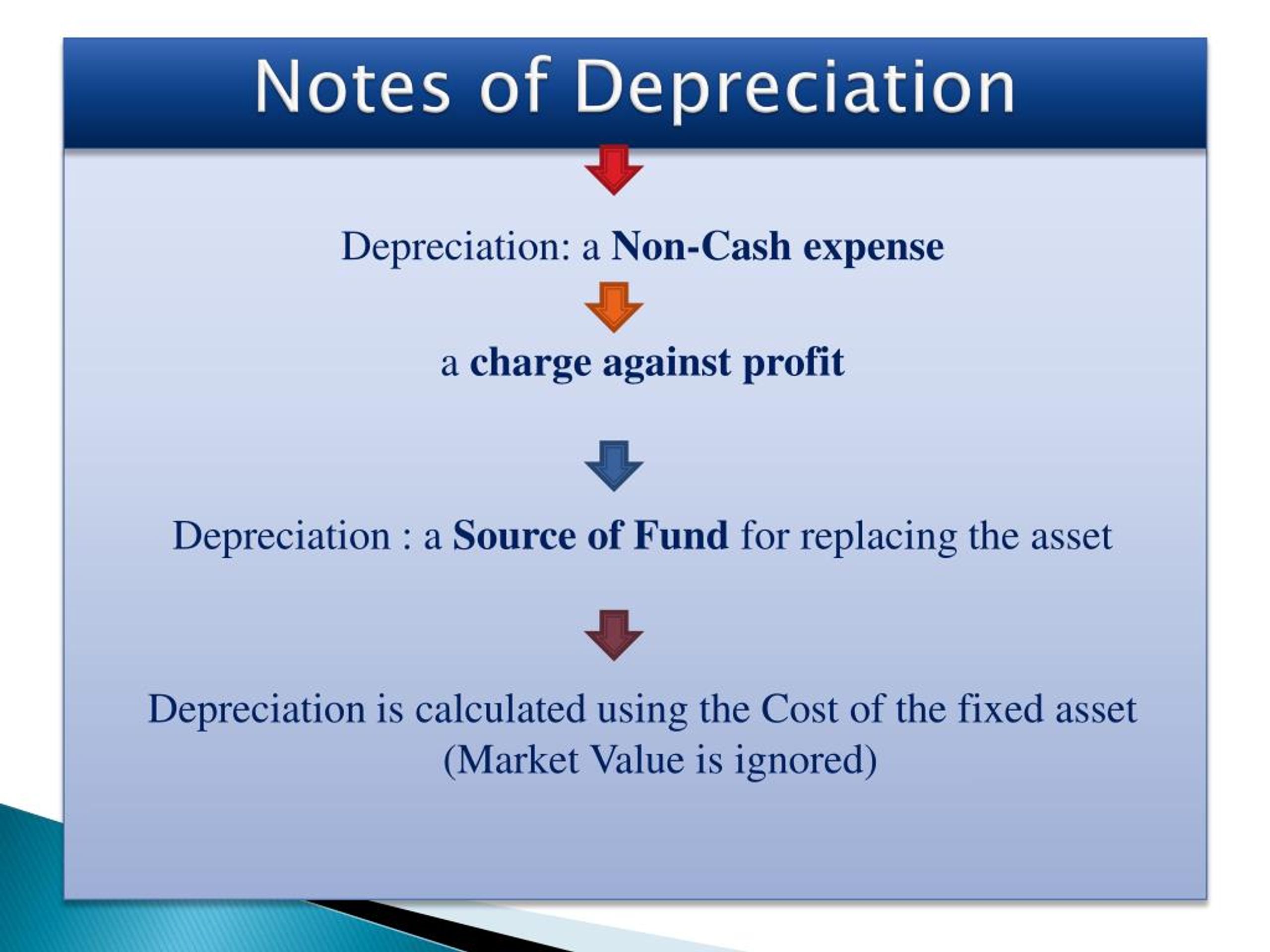

Depreciation expense is that portion of a fixed asset that has been considered consumed in the current period. Conceptually, depreciation is the reduction in the value of an asset over time due to elements such as wear and tear. This amount is then charged to expense.

Study With Quizlet And Memorize Flashcards Containing Terms Like A Manufacturer's Inventory Consists Of What Type Of Inventory?, The Depreciable Cost Used In Calculating Depreciation.

Depreciable cost is the combined purchase and installation cost of a fixed asset, minus its estimated salvage value. The depreciable cost used in calculating depreciation expense is: End_period — period to end calculating the depreciation (the unit used for the period must be the same as the unit used for the life;

Depreciable Cost Is Used As The Basis For The Periodic.

Regardless of the method used, the first step to calculating depreciation is subtracting an asset's salvage value from its initial cost. The difference between its replacement. The amount allowable under tax depreciation methods.

Depreciation Expense Is Referred To As A Noncash Expense Because The Recurring, Monthly Depreciation Entry (A Debit To Depreciation Expense And A Credit To.

Netbook value is calculated by subtracting accumulated depreciation from the cost of the asset. Depreciation expense = total cost of an asset/estimated useful life. It is the cost minus the expected salvage value.

The Scrap Value At The End Of Its Estimated Useful Life.

Divide 18,000 by the 100,000 hours of estimated life that the car has, leaving you with 0.18. The amount of an asset's cost that will be depreciated. Depreciation is the accounting process of converting the original costs of fixed assets such as plant and machinery, equipment, etc into the expense.

In Other Words, The Company Can Depreciate $95,000 Of The Machine’s Cost Over Time.

Firstly, three important factors determine the depreciation of an asset: It refers to the decline in. The depreciable cost used in calculating depreciation expense is a its service from acct 201 at university of nebraska, lincoln

Popular Posts

Iv Calculations Practice Questions And Answers

- Get link

- X

- Other Apps

Familial Pancreatic Cancer Risk Calculator

- Get link

- X

- Other Apps

Comments

Post a Comment